When it comes to investing in gold and silver, no single method is tailor-made to fit all people. It depends on the individual’s desired outcomes and conditions. On the whole, however, the optimum choice for investing in precious metals is to procure physical bullion and secure it securely.

Gold bullion is a worthwhile investment, with coins and bars available in a range of sizes from tiny 1-gram pieces to hefty 400-ounce units. The American Gold Eagle and Canadian Gold Maple Leaf are popular selections, both composed of 99.5% pure gold. Investing in gold is an established strategy to hedge against stock market volatility, and gold bullion provides a reliable way to achieve this goal.

With the exception of physically investing in gold, buying a gold ETF is the next most conventional method. Situated on stock markets, they take on the character of, and therefore accurately follow the price of gold. The SPDR Gold Trust is one of the more prevalent gold ETFs (GLD) and provides a hassle-free approach to investing, absent from the typical duties of preserving and safeguarding tangible gold bullion.

Gold miners are a great alternative for those seeking to capitalize on gains in the gold market. Primarily consisting of stocks of mining companies, gold miners provide merchants the opportunity for higher returns if the price of gold rises. While they can be considered a more high-risk investing decision than a gold ETF or bullion, the potential returns are valuable resources for entrepreneurs and investors alike.

Gold futures provide you with the promise of a profitable endeavour; an agreement that allows you to purchase gold at an agreed-upon price at a future date. An investment in gold futures is more speculative than other gold instruments such as bullion or exchange-traded funds, but the potential profits may far outweigh the risks if the price of gold continues to climb.

When it comes to investing in gold and silver, the decision of how to proceed depends on specific goals and individual parameters. Those searching for a more secure form of ownership may prefer to acquire physical bullion through the purchase of gold bars or coins. Meanwhile, those aiming for a riskier but potentially more rewarding outlay may look to gold mining stocks or gold futures as their ideal investment option.

Related Product

MCD Polishing Cutter for Gold Silver

Product Information Origin Tianjing, China Whether To Coat Uncoated Brand MSK Unit Weight 0.3kg Tool material Tungsten steel bar imported from Germany Product Size Shank Dia […]

MCD Turning Tool Mirrow Finish R Cutter

Product Information Product Name Single Crystal Diamond Lower Chamfering Inner R Cutter Brand MSK Handle Material Tungsten Steel Blade Material Customized Pcd, Single Crysta […]

Diamond Turning Tools Outer Jewelry R Cutter

Product Information Origin Tianjing, China Material Tungsten Steel Brand Msk Type Half Round Key Milling Cutter Product Name Single Crystal Diamond Side Edge Arc Milling Cut […]

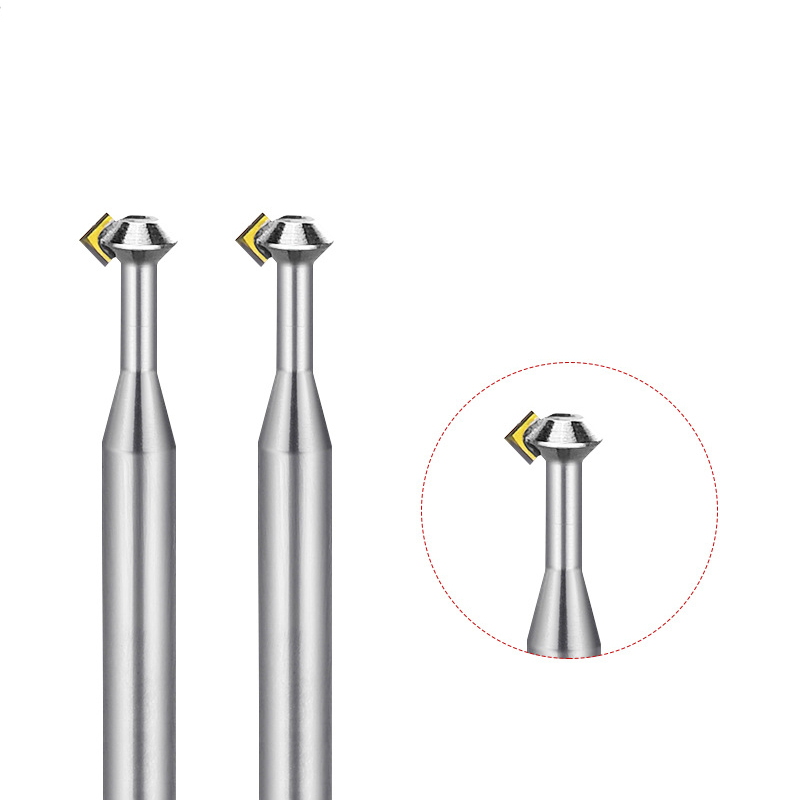

CVD/PVD/MCD Gold Jewelry Diamond Engraving Cutter

Parameter Product Name Single Crystal Diamond Carving Cutter Rotating Speed 10000-30000r/min Tool Nose Width 0.1-6.0mm Feed 1500-5000mm/min Blade Material Single Crystal Dia […]

Single Crystal Diamond Polishing Cutter

Origin Tianjing, China Shank Diameter 6 (mm) Brand MSK Blade Change Method The Diamond Is Welded To The Cutter Body As A Whole Material Single Crystal Diamond (MCD) Scope Of […]

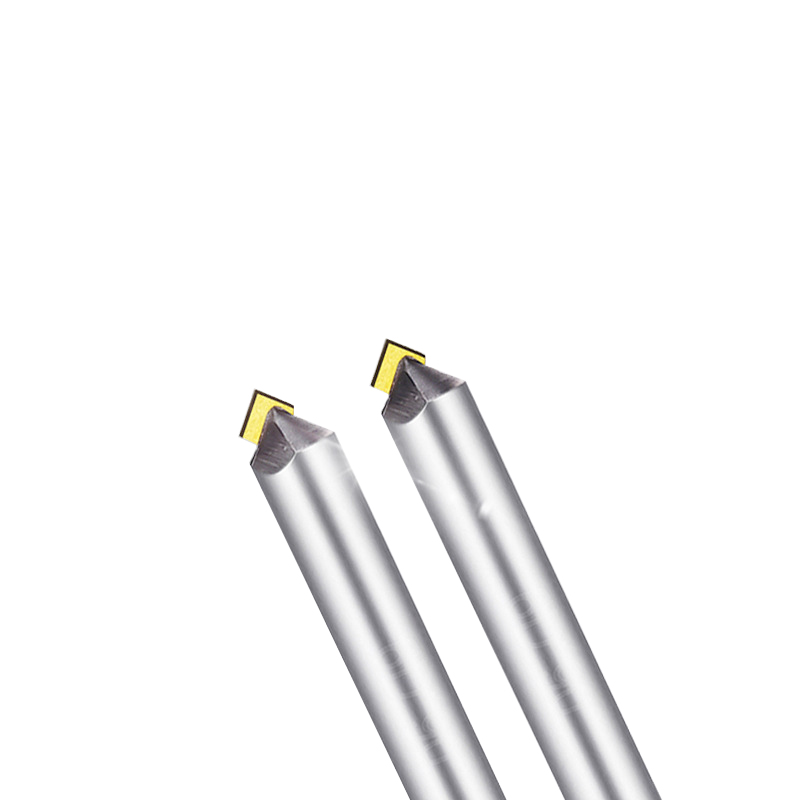

Lathe Bits MCD High Gloss Chamfer Tool

Product Information Origin Tianjing, China Cutting Edge Form Straight Edge Brand MSK Material Single Crystal Diamond Chamfer Angle 30°-180° Type Angle Milling Cutter Minimum […]

MCD High Gloss Chamfer Cutter For Gold

Product Information Origin Tianjing, China Type Flat Milling Cutter Brand Msk Whether To Coat Uncoated Series Cutter Milling Cutter Processing Range Clocks And Watches, Copp […]

Post time: 2023-06-23